Scan, Store, Secure: How Long Should You Keep Your Important Documents

It happens to all of us: piles of papers build up over time, and suddenly, you’re drowning in bank statements, receipts, and insurance policies. But how long do you actually need to keep these documents? And once you’ve figured that out, how do you organize and preserve them without taking up every drawer in your home? Digitizing them will make all the difference; that’s where Genius Scan comes in. Here’s a guide to the most important documents you’re legally required to keep in the United States, and for how long.

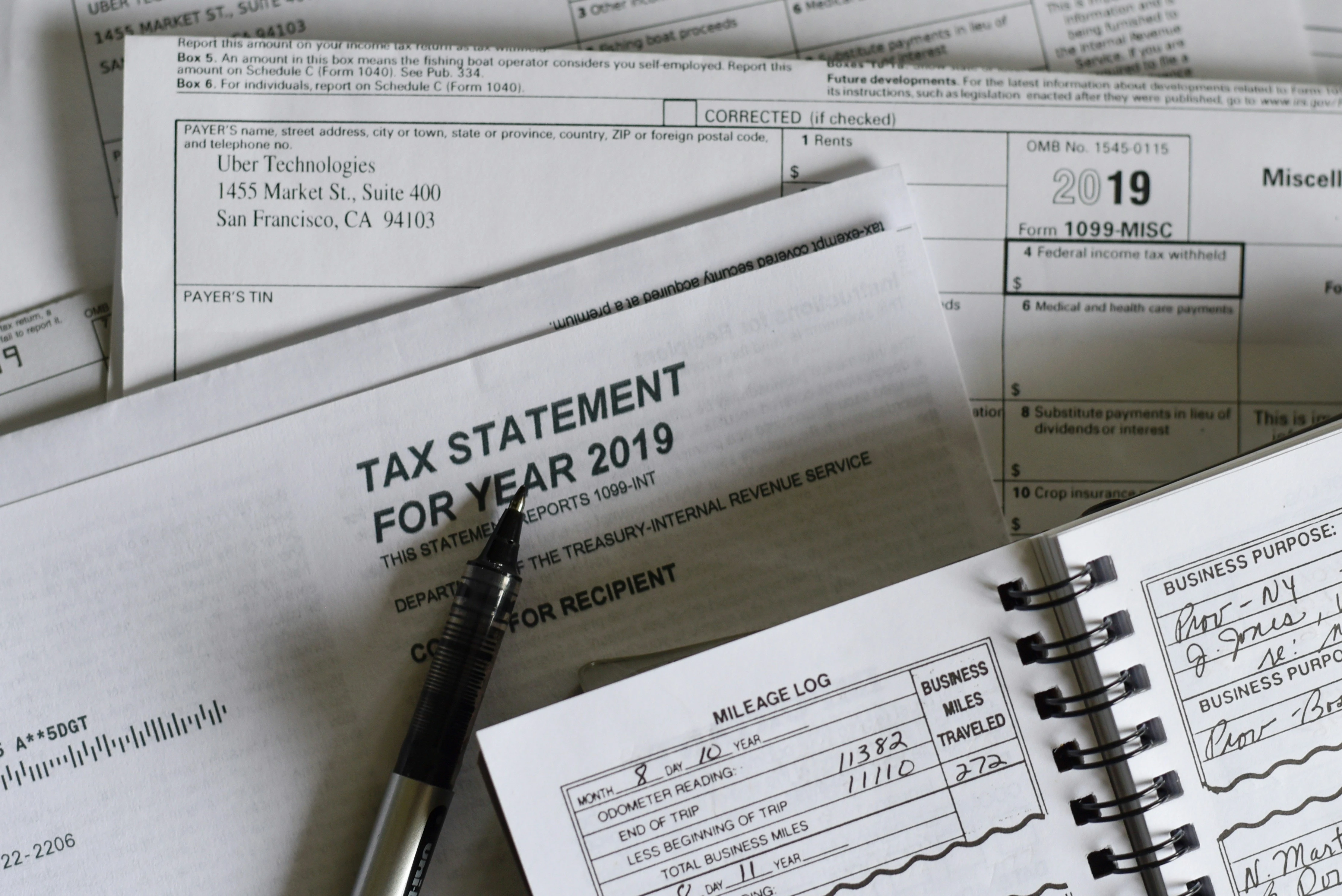

Tax Documents (Keep for 3–7 Years)

Tax records are among the most commonly referenced documents, and the IRS has clear guidelines on how long to hold on to them. At a minimum, keep your tax returns, W-2s, 1099s, and receipts supporting deductions for three years, which is the standard IRS audit window.

However, if you’ve claimed a loss on worthless securities or bad debt, it’s recommended to retain those records for seven years. Digitizing your tax documents not only protects them from wear and tear but also makes them easier to organize by year, back up securely, and share instantly with your accountant when tax season rolls around.

Employment Records (Keep for 7 Years)

Employment records like pay stubs, contracts, and termination letters should be kept for about seven years after you leave a job. These documents can be critical for resolving disputes, verifying your income for Social Security benefits, or filing for unemployment.

Scanning them into a digital archive ensures you can retrieve your complete job history quickly when applying for a new role or filing a claim.

Insurance Documents (Keep As Long As Policy Is Active + Claims Period)

For every kind of insurance — health, home, auto, or life — it’s important to keep policy documents, payment records, and correspondence for as long as the policy is active, and for several years afterward in case of disputes or retroactive claims.

Emergencies rarely give you time to hunt for paperwork. Having your insurance information digitized allows you to access policy numbers, coverage details, or claim history instantly from your phone, wherever you are.

Medical Records (Keep Indefinitely)

Medical records are best kept indefinitely, especially if you’re managing a chronic condition or need a complete health history across different providers. These include vaccination records, test results, prescriptions, and diagnosis summaries.

A digital archive of your medical history ensures accurate, quick sharing with new doctors, helps coordinate care, and protects vital health information from being lost in a move or paper shuffle.

Business Records (Keep Indefinitely)

For entrepreneurs and business owners, some documents should never be discarded. Articles of incorporation, financial statements, meeting minutes, and business licenses should be retained indefinitely for legal, tax, and operational continuity. Paper documents fade. Digitizing these critical records minimizes the risk of loss or damage and makes audits, compliance reviews, or internal planning much easier to manage.

From short-term tax forms to lifelong medical records, document retention isn’t just about staying compliant, it’s about staying prepared. Scanning and securely storing your documents with Genius Scan gives you access to what you need, when you need it. It’s the easiest way to clear the clutter and keep your life organized for the long haul.